what is an open end mortgage with future advance clause

Future advance mortgages are lines of credit that are secured with a piece of property or other asset. These loans secure property for future credit.

What Is A Future Advance Mortgage

An open-end mortgage acts as a lien on the property described in the mortgage.

. For example lets say borrower takes out a loan for 100000 that the lender secures with a mortgage and. Clause in an open-ended mortgage permitting the mortgagor to borrow additional sums of money in the future pledging than same real property. That the parties intend the mortgage to secure any future advances.

Future advance does not require you to adjust borrowing. This is an open-end mortgage under 42 pa. Updated May 08 2019.

With Future Advance Clause 1. An open-end mortgage acts as a lien on the property described in the mortgage. Section 8143 which secures future advances.

A future-advance mortgage contains a clause that permits a borrower to receive more money after the initial agreement has been made. 5 EAST CALL STREET. THIS IS AN OPEN-END MORTGAGE UNDER 42 PACS.

Definition of Future advance clause. The maximum amount secured by this open-end mortgage is two hundred percent 200 of the. For example lets say borrower takes out a loan for 100000 that the lender secures with a.

The clause will say something along the lines of. Future advances clause samples We are offering Shares in the amount of up to 5700000 in this offering. A future-advance mortgage says in one of its clauses that the house is also collateral for loans that havent been made yet.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as. 5301232 requires the mortgage must state. Some examples of future-advance.

OPEN-END REAL ESTATE MORTGAGE. IA 50511 515 295-3595. An open end mortgage a future advance clause will typically have a higher interest rate than a traditional mortgage would have.

This Mortgage is an open-end mortgage that secures existing indebtedness Future Advances and Protective Advances as such. The maximum amount of unpaid loan indebtedness exclusive on. A future advance is a mortgage clause that allows a borrower to get additional money to increase a mortgage loan.

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement. A future-advance mortgage involves a clause that.

Federal Register 2012 Truth In Lending Act Regulation Z Mortgage Servicing

Final Exams To Be Used In Preparing For The Salesperson California Real Estate License Test By Thomas E Felde 2015 California Real Estate Ppt Download

Exhibit 10 171 Open End Mortgage

Reverse Mortgage Insurance Explained 2022 Update

Mortgage Terms Treadstone Funding Grand Rapids Mi

Exhibit 10 171 Open End Mortgage

Personal Banking Business Banking Mortgages Loans North Shore Bank

Browsing Mercer University School Of Law By Subject Property

What Is A Future Advance Mortgage

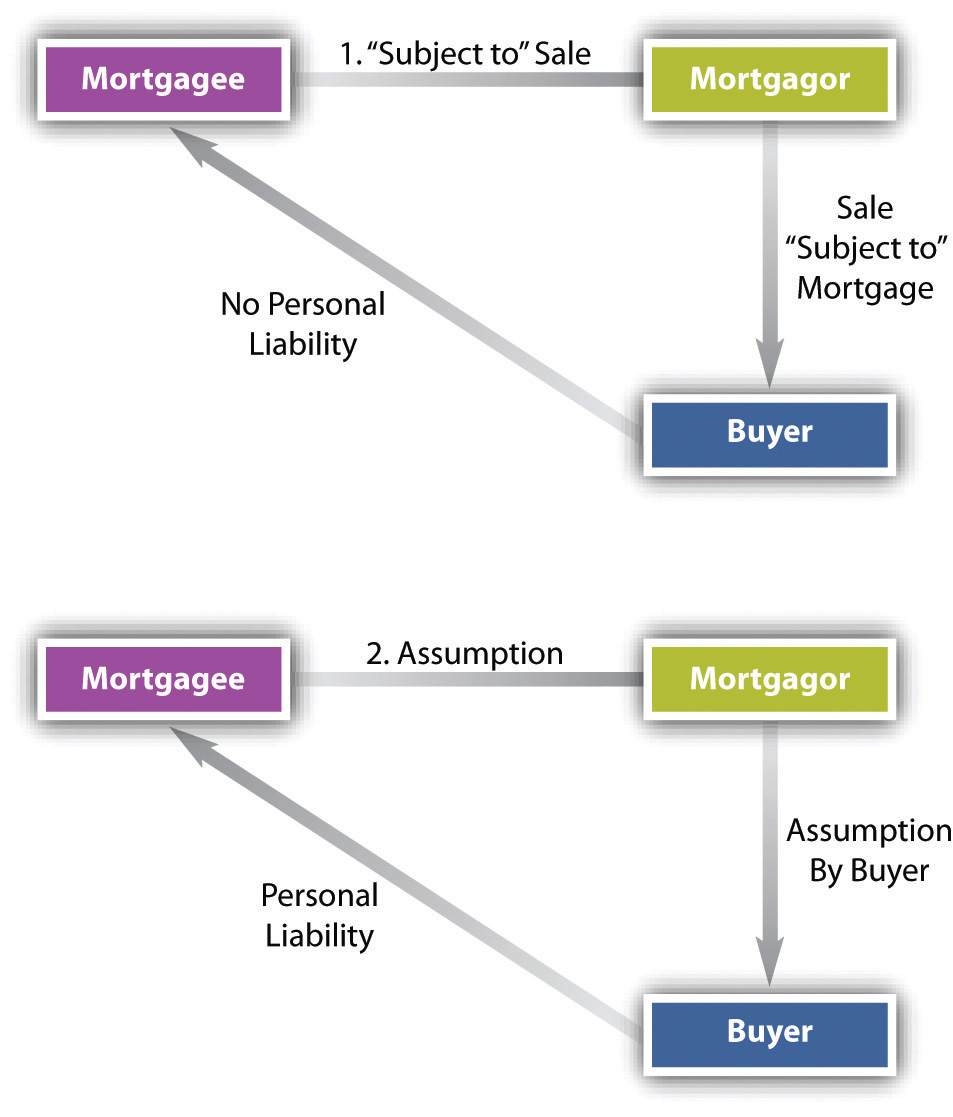

Priority Termination Of The Mortgage And Other Methods Of Using Real Estate As Security

Personal Banking Business Banking Mortgages Loans North Shore Bank

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Federal Register 2012 Truth In Lending Act Regulation Z Mortgage Servicing

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Masters Of Underwriting Smoothing Out The Home Saver Underwriting Process Ppt Download

/financial-advisor-having-a-meeting-with-customers-1063755234-b46e99664aef4dc895350b244429ac97.jpg)